Finding the right home feels exciting – but being pre-approved for your loan is what makes it possible. Whether you’re planning to buy soon or still just thinking about it, getting pre-approved is one of the best moves you can make. Here’s why.

1. What Is Pre-Approval, Really?

Pre-approval is much more than a guess. It means a lender has reviewed your finances (things like your income, assets, credit score, debts, and savings) and told you how much they’re willing to let you borrow for your loan.

It’s basically a reality check for your home search, so you can make sure it aligns with your budget and shop confidently when you’re ready to go.

2. Why It’s a Power Move (Especially Right Now)

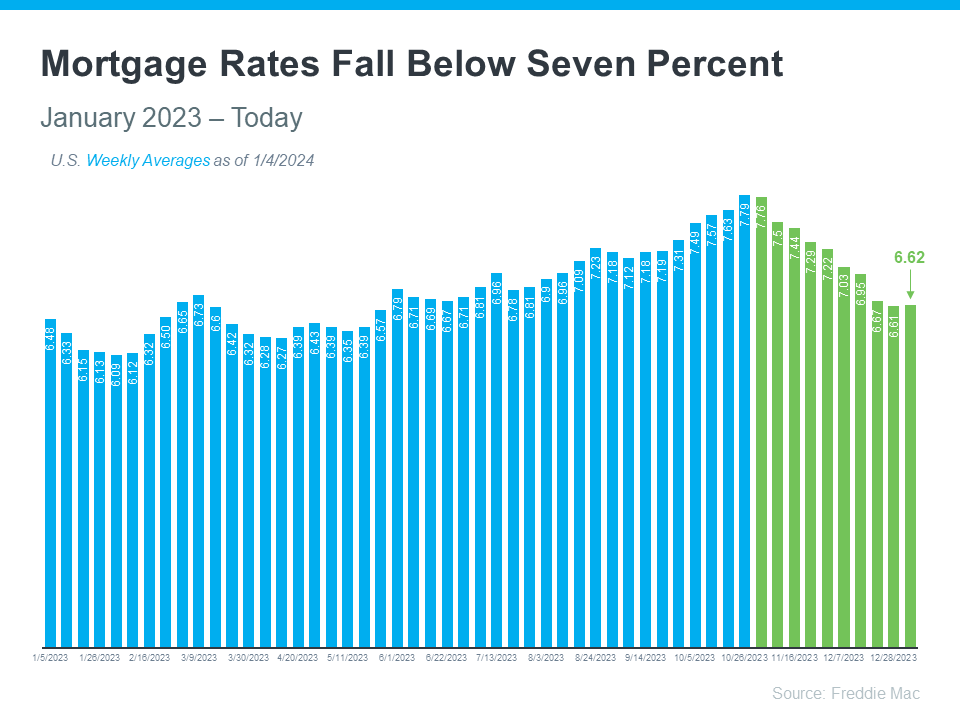

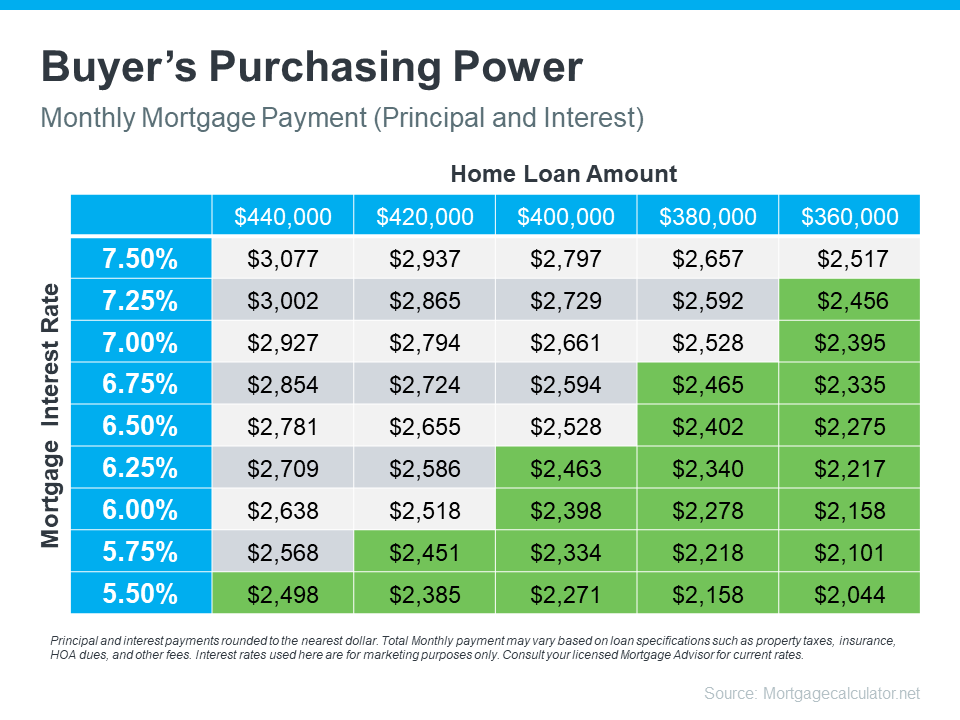

The housing market’s been shifting lately with mortgage rates moving, prices moderating, and inventory rising. So, knowing what you’re working with in the current market is a big reason why pre-approval matters. Here’s what it gives you:

- Clarity: You’ll know what you can afford before you fall in love with a house that’s potentially out of reach.

- Confidence: Sellers will take your offer seriously when they see you’re pre-approved because you’re not a risky buyer.

- Control: If rates come down and you want to jump on the moment, you’re already a step ahead with your plan.

As Experian explains:

“. . . you’ll want to make sure you receive your preapproval letter before you start looking at homes so you can submit a strong offer as soon as you find what you want. The process can take anywhere from a day to a few weeks, so if you procrastinate, you may lose out to a competing offer.”

And once you find a home you want to put an offer on, pre-approval has another big perk. It not only makes your offer stronger, it shows sellers you’ve already undergone a credit and financial check. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“Preapproval carries more weight because it means lenders have actually done more than a cursory review of your credit and your finances, but have instead reviewed your pay stubs, tax returns and bank statements. A preapproval means you’ve cleared the hurdles necessary to be approved for a mortgage up to a certain dollar amount.”

Translation: Pre-approval helps you make stronger, more informed decisions – and it helps you avoid missing out on a home or getting stuck on the sidelines when the right one hits the market. Because the reality is, competition might be lower these days, but desirable homes (especially the ones that are priced well) still go quickly.

3. Don’t Wait Until You’re “Ready”

Think of it this way: pre-approval doesn’t mean you’re buying a house tomorrow. It just means you’ll be ready when the time comes. And most pre-approvals are good for 60–90 days and can be refreshed easily if your plans change.

So, here’s a good place to start. Ask yourself this question: “If the perfect home came along today, would you be ready to make an offer?”

If your answer is “not quite,” then pre-approval is your next step.

Bottom Line

Pre-approval doesn’t box you in. It opens doors.

In today’s market, buyers who win aren’t the ones who wait. They’re the ones who plan. So, if you’re even thinking about buying in the next few months, get ahead of the game by letting me connect you with a trusted lender.

They’ll help you understand what how the process works and walk you through every step along the way, so when the right home pops up, you’re ready.

Shawna O’Brien

Residential Broker

KW Portfolio Collective, Geist Fishers

317-506-0039

ShawnaOBrienRealtor@gmail.com