Should you buy a home now or should you wait? That’s a question a lot of people have these days. And while what’s right for you is going to depend on a lot of different factors, here’s something you’ll want to consider as you make your decision.

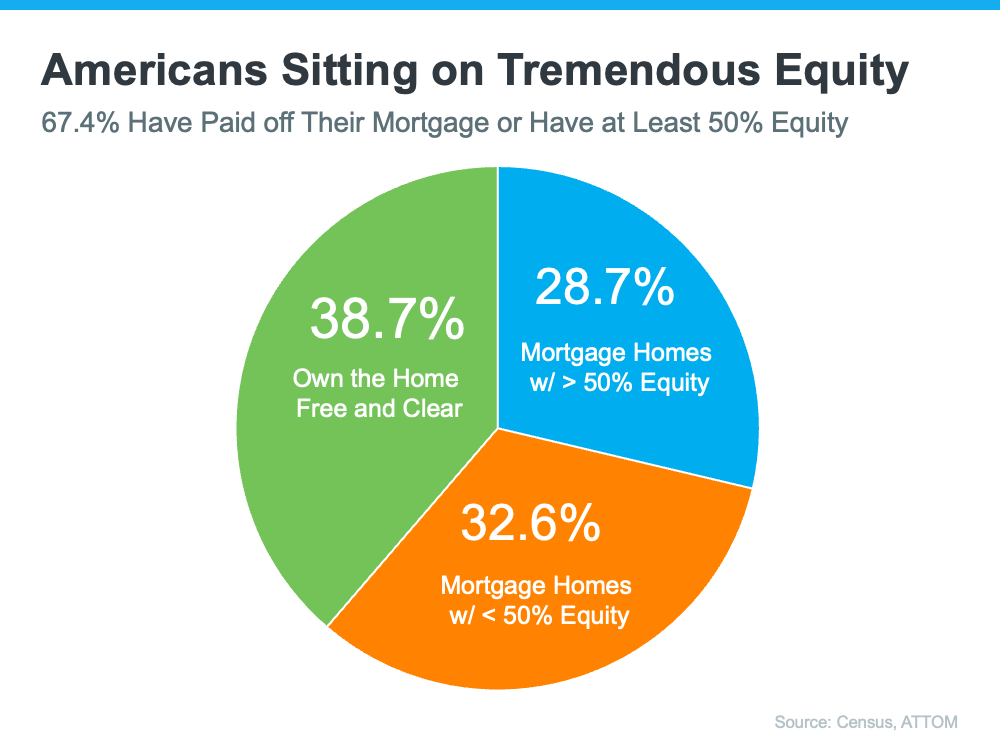

As soon as you buy, you’ll start gaining equity. And you’d be surprised how quickly that can add up – even with more moderate home appreciation.

Each quarter, Fannie Mae releases the Home Price Expectations Survey. It asks over one hundred economists, real estate experts, and investment and market strategists what they forecast for home prices over the next five years. In the latest release, experts project prices will continue to rise nationally through at least 2028 (see the graph below):

While home prices are going to vary from one local area to the next, this shows they’re expected to keep going up nationally. The size of the increase varies from year-to-year, but the important takeaway is that prices are forecast to rise every single year – just at a moderate pace.

And while rising home prices may not sound great right now, once you own a home, that growth will be a big bonus for you. Here’s a look at what you stand to gain equity-wise once you buy. The graph below uses a typical home’s value and those HPES projections to show how much equity is at stake:

If you bought a $450,000 home at the beginning of this year, based on that starting value and the expert forecasts from the HPES, you could gain more than $90,000 in household wealth over the next five years. That’s significant.

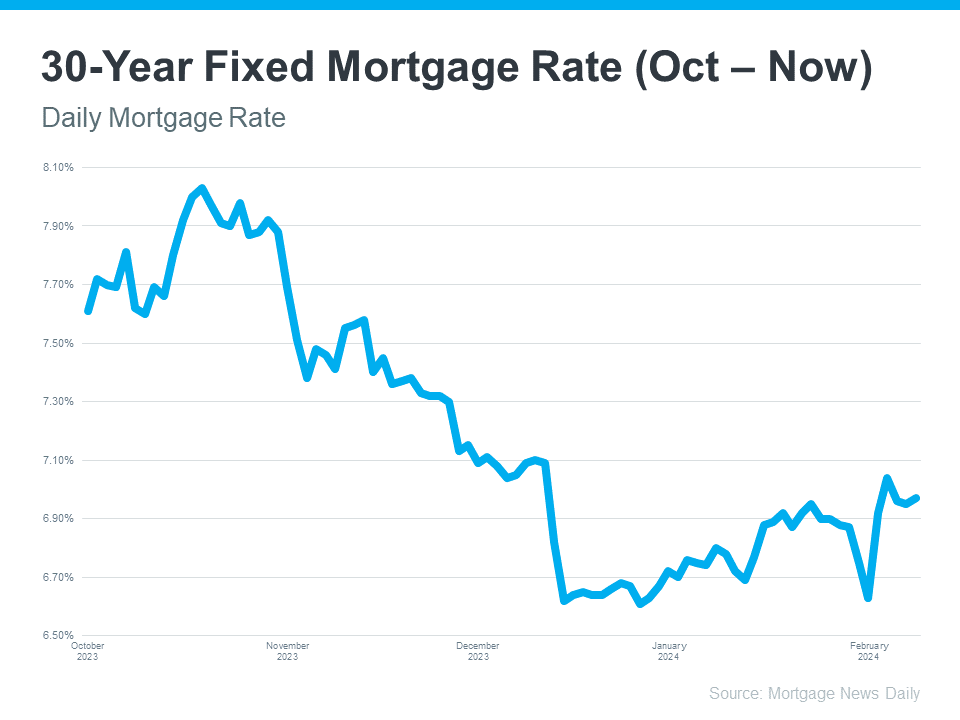

So, if you’re ready and able to buy, and growing your wealth is important to you, you’ve got an opportunity in front of you. And now that mortgage rates have fallen, it may be time to consider making a move.

To talk more about your options and what makes sense, lean on a pro. They’ll be able to tell you what home prices are doing in your area and what that means for your move (and your future equity). The Mortgage Reports says:

“Given the intricacies of the current market, it’s more important than ever to stay informed and up to date about housing market conditions. Whether you’re looking to buy or sell in the remaining months of 2024, having a professional guide you through the process can make all the difference.”

Bottom Line

The decision to buy now or wait is a very personal one, but it’s valuable to have an expert’s perspective. If you want help weighing your options and thinking through how the current market factors in, connect with a local real estate agent.

Shawna O’Brien

Residential Broker

KW Portfolio Collective, Geist Fishers

317-506-0039

ShawnaOBrienRealtor@gmail.com